(commentary)

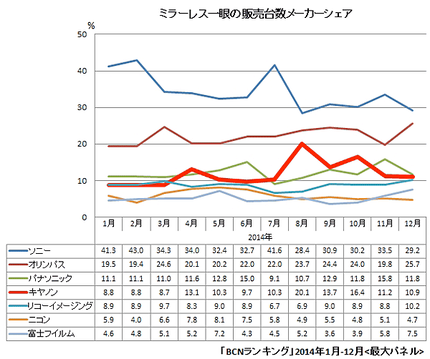

BCN published their 2014 summary of mirrorless camera sales in Japan by month (numbers are market share):

From top to bottom that’s Sony, Olympus, Panasonic, Canon, Ricoh, Nikon, and Fujifilm. And one thing to remember about BCN is that it does not track all retail sales in Japan, only a large subset of them.

As usual, various Web sites are interpreting this data differently, as in “Olympus gains market share,” or “Canon still struggling.”

Okay, we’re talking about the Japanese market, so what does CIPA say about that? Through November 2014, the year-to-year mirrorless shipments to Japan were 87% what they were the previous year. So put those “we’re the best” claims in perspective: the market declined ;~). You’re the king of a smaller hill. Oh, and last year? Olympus had the top market share in Japan, so exactly how is it that “gains market share” can result in dropping a peg to number two?

Individual data slices aren’t as revealing as multiple slices. For example, using BCN’s yearly numbers (Disclaimer: BCN changed the way they counted in 2014, going to a straight brand share instead of top 20 products determining share), we can see that Panasonic slid from nearly a 40% market share in Japan in 2010 to about 13% in 2014. That’s significant. Especially when you realize that such sales themselves peaked in the middle of that timeframe. Sony started strong in mirrorless in Japan, lost steam, then regained it. Nikon started modestly and has lost momentum. Canon started even more modestly and gained a bit of momentum.

One thing that’s becoming clearer and clearer is that regional preferences for cameras are steering the industry in interesting ways. Ricoh’s oddball and very small Q series is doing better than Nikon 1 in Japan. Of course, over here in the US, big DSLRs just clobber mirrorless sales, and the mirrorless cameras that do sell tend to be larger and more DSLR-like (e.g. EM-1, XT-1, etc.).

Many years ago the Japanese auto makers started opening design centers in the US. Why? Because US customer preferences were different than Japanese preferences. Camera makers may need to do something similar.

Indeed, there’s a sub-component at play: software. By keeping their design centers so unabashedly Japanese, I think camera makers aren’t seeing software, user interface, and Internet trends correctly. There’s a bad lag before what’s actually happening on those fronts gets back into the camera companies, and another lag before that translates into changes in designs. That’s just one of the reasons why the camera companies are not competitive with even what a smartphone can do with its camera.