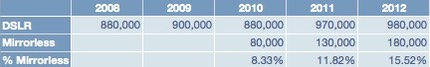

Mirrorless camera penetration is low in some markets (US, Europe) and high in others (Japan, SE Asia). In my on-going attempt to bring you that information as we learn it, here's what the German market looks like (according to prophoto-online.de, in a brochure they were distributing at Photokina):

2012 numbers are estimates. The % Mirrorless numbers are the percentage of mirrorless cameras to overall interchangeable lens digital cameras.

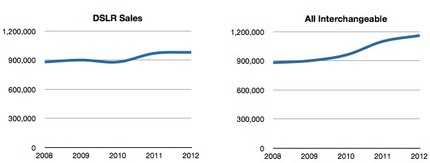

Below, the numbers of just DSLR sales versus DSLR+mirrorless sales are graphed. Just DSLR sales? Looks kind of flat (left chart). DSLR+mirrorless? Looks like the market is growing (right chart). This, of course, is one of the reasons why we're seeing so much interesting in mirrorless by so many camera companies. DSLR sales are dominated by two companies (Canon and Nikon) with a third taking up most of the rest (Sony). Canon and Nikon were late to mirrorless, so growth there was mostly grabbed by the other players (Olympus, Panasonic, and Sony).

Variations of these charts play out similarly across the different regions: DSLR sales show modest growth at best, but add in mirrorless and interchangeable lens cameras show more dramatic growth. The non Canon/Nikon players couldn't win at the DSLR game, but they think they can grab back sales via attacking where the Big Two weren't. The interesting thing to watch will be to see if things change now that Canon is entering the market. The squeeze on the "other players" may be back on.