I finally got around to looking at the information CIPA was going to present at CP+ earlier this year (they released an online version of the yearly CIPA summary in March, when we were all distracted). No big revelations in the data, though some confirmation of trends we already knew about.

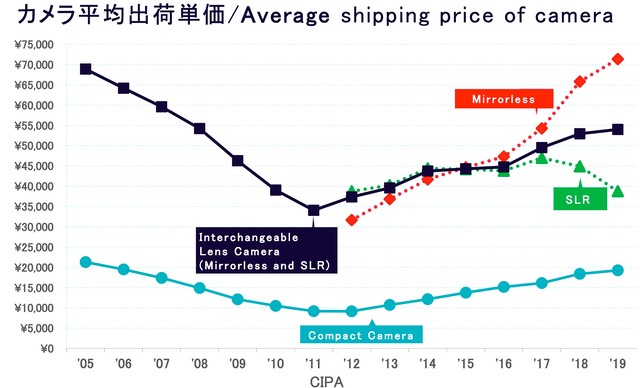

I'm covering the CIPA presentation here on sansmirror instead of the usual dslrbodies site because of what the data suggests. For instance, this chart:

This is an interesting, but not unexpected, trend. While DSLRs are basically still selling at the same overall value range as they decline, the compact cameras and especially mirrorless cameras are seeing a rise in selling prices.

That will be misread by many. So let me explain. In the DSLR realm, we've had high-priced top end cameras like the 1DX and D6 for almost two decades, as well as a wide array of products underneath that, from low-end consumer DSLRs (D3xxx, Rebel), up through mid-level and prosumer cameras. This graph suggests that, while DSLR volume has declined dramatically, the mix of the types of DSLRs being bought hasn't changed a lot.

That's clearly not true of mirrorless. Between 2012 and 2019 the range of mirrorless models changed considerably. We now have mirrorless cameras that cost as much as US$10,000 (e.g. Fujifilm GFX 100). Also, we now have five players selling high-end full frame mirrorless cameras (Canon, Nikon, Panasonic, Sigma, and Sony). We didn't have all those expensive models at the start of that upward trend.

That said, the fact that the average price of the mirrorless cameras being sold is now well above that of DSLRs tells us that it is well-to-do and likely serious photographers that are fueling that upward trend. That, too, has a simple explanation: DSLR volume is down, and the high-end DSLR long-term user has been sampling/switching to high-end mirrorless as they become more capable. That also explains the modest dip in the last two years for average DSLR price. The higher end DSLR user isn't always buying a new DSLR when they buy, they're sometimes buying mirrorless.

CIPA doesn't graph it together, but lenses for interchangeable cameras are doing something interesting, too. While the number of lenses actually shipped has dropped significantly in the last eight years, the pricing of those lenses hasn't had nearly the same level of decline. Shipments declined about 54% since peak, but the value of those shipments declined only 30%.

So if you've been thinking you're spending more on your hobby lately, you probably are.

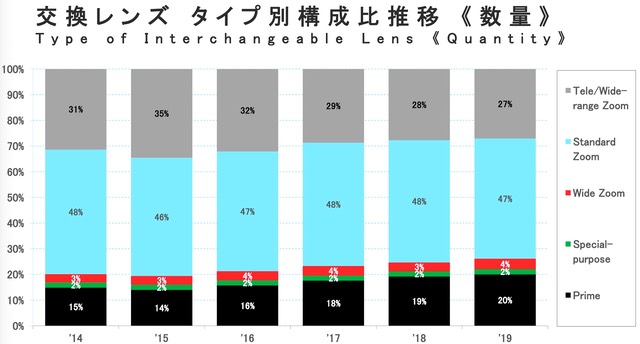

Another thing probably being driven by mirrorless is the type of lenses that are selling:

Note the increase in primes being sold. While not a big change over time, I'm pretty sure that, as people move from DSLR to mirrorless, that is driving at least some "prime replacement" activity. Note also that while the Internet is always talking about wide angle zooms and how much they want one, they're not exactly a best seller in the lens category. Indeed, far from it.

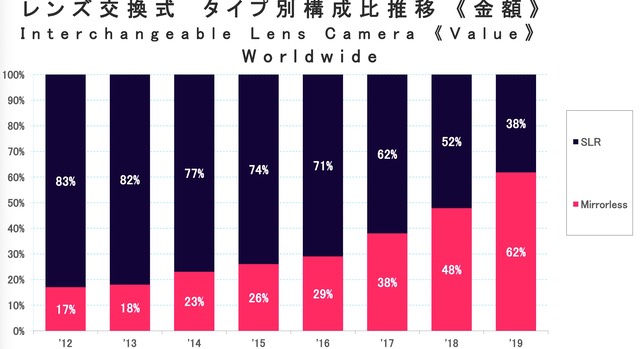

Several years ago I predicted that mirrorless would catch and surpass DSLR volume in 2021. It looks like that might have sped up by about six to twelve months, as the 2019 mirrorless market share jumped up from 38% to 47%. But getting back to the first point I made:

Full frame mirrorless is driving that upwards march in terms of sales value. Europe and the Americas lag at this, and significantly so. In the Americas, mirrorless was 37% of the value (Europe 41%). It's really China and Japan that are driving the mirrorless progression faster at the high end.

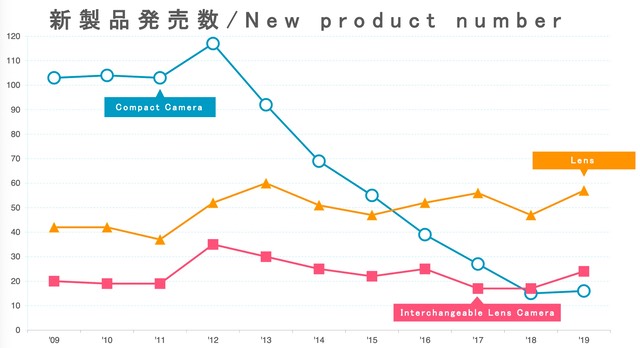

Finally, if you think you haven't seen a lot of new compact camera models lately, you're right:

The ILC makers are still iterating at a reasonably consistent rate, but the compact makers have decimated their iteration.

Basically, the camera market chugged along in 2019 with much the same trend lines as before. Obviously, things will be different in 2020 due to the worldwide pandemic. We've only had four new mirrorless cameras announced to date; last year at this point it was nine models introduced in the same period. According to CIPA, production of mirrorless models was about three-quarters that of the previous year in the first quarter (shipments were about four-fifths, meaning inventory is being diminished slightly).

Where things go from here is unknown. Several upcoming product introductions I know about are slowly getting pushed backwards on the schedule. It's tough to sell a new product when folk can't go into a store and look at and handle it. The crazy leading-edge buyers will still be there ordering online the minute the gates open, but in terms of overall product volume, they're not as big a group as most people think. They're just vocal.

Normally this time of year I've posted my predictions for the full year. This year, all bets are off, and I won't be making any. There's no stable variable that you can point to in order to base a prediction on.

This has to be driving the management (working from home) at Canon crazy, as they had planned to put the pressure back on Sony in full frame with two new cameras and six new lenses by now, with another big set of mirrorless releases in the fall. Now it's starting to look like all that will be trickle-managed to keep Canon's name in the news. (You can already see that in action with the way the R5 was pre-announced, then details trickled out instead of actual camera shipments.)

Sony, meanwhile, hasn't announced any camera so far in 2020, while they had announced four in the first half of 2019. Likewise, one lens versus four.

So get used to a more leisurely product introduction pace for a bit. How long that bit will last is anyone's guess. Economies have to reopen and rebound for things to get back to normal for the camera makers.