(news & commentary)

BCN has reported the final market share numbers for 2013 and awarded their "top three" sellers for the year:

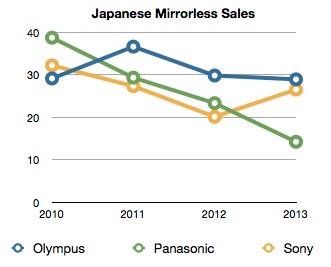

In 2010, the three top players had basically 100% of the market share in Japan. The products on the market at that point were Olympus E-P1, E-P2, E-PL1, Panasonic GH-1, GF-1, G10, G2, GH-2, GF-2, and Sony NEX-3 and NEX-5. Samsung also had early products, though they don't tend to sell well in Japan. Ricoh also had introduced the GXR, though it's unclear whether BCN tallied this camera in their rankings.

In 2011, the top three were down to 93.2% of the market, mainly because of the late entry of the Nikon 1 models and the introduction of the Pentax Q. Sony's numbers went down that year, partly because the NEX-7 got delayed in shipments due to the Thailand floods.

In 2012 the top three's market share was down to 73.2%, with Nikon offering deep discounts and Fujifim plus Canon entering the mirrorless market.

By 2013 the top three market share had fallen to 69.6%, mostly because of Panasonic's weakness, but also with essentially all the players now in the market grappling for market share.

Remember, BCN's numbers are about what is actually bought at retail (in Japan), not what was shipped into the country or put on store shelves. BCN collects cash register receipts from about half the Japanese retail outlets and analyzes them for trends on a weekly, monthly, and yearly basis. The majority of the products generating the volume in mirrorless in Japan are the lower end, lower cost, or discounted models. For example, the top mirrorless cameras in last week's interchangeable lens camera listing were three different NEX-3N kits, the NEX-5R, the EOS M two-lens kit, and the E-PL5 two lens kit, in that order. All these are in the US$350-550 range. The Olympus E-M1 with the 12-40mm f/2.8 lens did show up at a respectable #16 position, though, which is quite good for the price point it's at (it was significantly more expensive than anything else in the top 20).

While there's been a lot of chatter about "will Olympus survive in the camera market," the real question is not Olympus, but Panasonic. Note that constant downward slope in a market they helped pioneer, in the best geographic market for the product! The GM1 isn't yet really showing up in the sales listings for BCN (currently at #47 and trending down), partly because it's fairly high priced compared to what's actually selling at the moment. Panasonic's CEO has already said that businesses that don't achieve 5% ROI will be shut down, and he's been making good on that promise lately by selling, partnering, and repositioning groups that don't make that mark and don't have a short-term plan to do so in the future.

I've written elsewhere that I expect Panasonic to pull a Sony with cameras: they'll meld their professional video and still camera groups together, I think. In the process, I'd bet that Panasonic also jettisons a number of underperforming products. Note that I'm not writing that Panasonic will leave the m4/3 business. I just believe we're going to see the entire camera division at Panasonic completely refocus on products they believe they can differentiate and sell profitably. Already their compact camera group is collapsing, and we can see the next generation GH becoming even more embedded in video with its 4K video focus. I expect fewer products from Panasonic in the future, but more focused.

I should also point out that Canon and Nikon are now dominating the rest of the camera market in Japan. They're number 1 and 2 in both DSLR sales and compact camera sales (Sony is surprisingly #4 in DSLR sales in Japan and #3 in compact). You have to expect both Canon and Nikon to make another play for the mirrorless market in Japan at some point.